How can I own my own home sooner?

Australian household debt is at record highs. Do you think you could manage if interest rates went up by a couple of percent? Have you got a contingency plan in place to make sure you’re not a statistic when interest rates eventually go back up?

Whilst a home loan isn’t necessarily ‘bad debt’, afterall, it’s allowing you to get your foot in the property market. But have you actually considered how much more you’re paying for your house other than what you put on the contract?

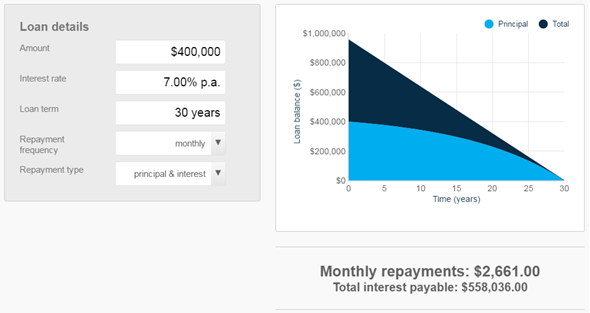

For example, say you buy a house for $500,000, you borrow 80% - $400,000 at 7% (somewhere near the historical average). You make monthly principal & interest repayments for 30 years. You will pay $558,036 to the bank in interest alone. Therefore, your $500,000 house will have cost you $1,058,036 over 30 years – more than double of what you actually paid! So it may not be bad debt, but it’s certainly not great…

On the above example, with some simple tips from Fast Track Wealth Services, you could easily shave at least 6 years and 3 months off your home loan whilst saving at least $136,560 in interest repayments. With the right advice from Fast Track Wealth Services, these savings can be even greater. We can help you own your home sooner and help you grow your wealth, but what would you do with the savings and how will you create extra wealth?

Our Fast Track to Wealth Program is a holistic and organic approach to helping you achieve your goals. Adam Farrell, our Debt Advice Specialist, will work with you and start from the ground up to formulate a strategy to help you reduce your debt and break the shackles of debt sooner than you might expect.

Are you suffering from too much debt? Too much credit card debt? Too much personal debt? Been on holidays and now you've got debt that you can't repay? Talk to us today to help get rid of this debilitating and unnecessary burden in your life and make sure it never happens again,

Strategies include:

- Paying off your home loans quicker

- Reducing your interest bills

- Debt consolidation - get on top of your debts sooner and pay less interest

- Review of your bad debt

- Making money available for investments

Flexible payment options to suit your lifestyle to make financial advice more available to everyday Australians.

see how much interest you’re paying in interest to your bank

DISCLAIMER:

1. This calculator is provided by Rice Warner (ABN 35 003 186 883) and published by AMP Life Limited (ABN 84 079 300 379) AFSL 233 671 (AMP Life).

2. The results provided by this calculator are indicative only, actual amounts may be higher or lower. They are based on the accuracy of the data entered into the calculators and a change in factors may vary the result.

3. No representation is made as to your capacity to borrow money or to repay any loan. To help you consider the impact of interest rate changes we suggest exploring the impact of a rise in interest rates.

4. The results do not constitute an offer to lend you money. Your financial situation and the suitability of a loan can only be assessed after a lender has made reasonable enquiries to ascertain these matters. Please be aware that your lender may also charge additional fees and charges.

5. The calculator and the results provided are generic and do not take into account your personal circumstances. The calculator is a guide only and is not intended to be relied upon for the purposes of making a decision in relation to a credit or financial product. The user should obtain professional advice before making any financial decision.

6. Other than as required by consumer protection law, under no circumstances will AMP Life and its related bodies corporate be liable for any loss and/or damage caused by a user's reliance on information obtained by using this calculator.